Table of Contents

ToggleIntroduction: The Ledger That Wouldn’t Balance

I remember one night when invoices stacked higher than my chai cups.

The numbers wouldn’t add up. Tax deadlines glared at me from the calendar.

I thought: If this is running a business… why does it feel like I’m stuck in a never-ending math test?

If you’ve ever been there, hunched over spreadsheets at midnight, and wondering where the month’s cash went, then here’s some good news for you:

AI apps for finance and accounting aren’t just for big corporations anymore.

They’re now affordable, practical, and powerful for freelancers, startups, and small businesses like yours.

From chasing down late invoices to predicting next quarter’s cash flow…

From spotting fraud before it drains your account to staying audit-ready all year long. AI gives you something priceless: peace of mind.

Your books stay clean.

Your decisions get backed by real data.

And your future? It starts looking a lot more planned and a lot less panicked.

Key Questions Answered in This Post

This post tackles the most common and most important questions small business owners, freelancers, and accountants ask about AI apps for finance and accounting.

Before we dive in, here are the key questions this guide will help you answer:

💼 AI in Bookkeeping and Accounting Basics

• What are the best AI accounting apps for small businesses in 2025?

• How can AI bookkeeping software help reduce human error and save time?

• Can AI automate expense tracking and reconciliation?

• Are there free AI bookkeeping tools for startups and freelancers?

• Which is better for automation — QuickBooks AI, Xero, or Zoho Books?

• Can small businesses rely entirely on AI accounting software for tax filing?

⚙️ Automation, Accuracy, and Financial Efficiency

• How can AI automate financial tasks like invoicing and expense categorization?

• What are the best AI tools for automating bookkeeping in 2025?

• How does AI improve accounts payable and receivable workflows?

• Can AI help predict cash flow or revenue trends accurately?

• How can AI tools cut bookkeeping time by 80–90%?

• Which tools combine AI-powered forecasting with expense management?

• How can AI simplify financial audits and compliance reporting?

🧠 Smart Forecasting and Decision-Making

• How does AI forecasting software like Fathom or LivePlan improve business strategy?

• Can AI predict seasonal trends and cash shortages before they occur?

• How does predictive analytics in accounting help small businesses grow?

• What’s the difference between AI financial forecasting and traditional Excel-based planning?

• How do businesses use AI-powered financial insights to make better investment decisions?

🔐 Fraud Detection and Data Security

• How can AI detect financial fraud or prevent data manipulation?

• Are AI-powered fraud detection tools like Darktrace or SAP Analytics Cloud worth it?

• What are the biggest security risks when using AI in accounting software?

• How do AI risk management systems protect against fake invoices or payroll fraud?

• Can AI ensure compliance with financial data privacy laws like GDPR?

🧾 Tax Compliance and Reporting

• How can AI tax software reduce compliance errors?

• What are the best AI tools for automating tax filing in 2025?

• Can AI automatically identify deductions and credits that small businesses often miss?

• How can AI accounting automation help prepare audit-ready financial statements?

💰 Cost, Value, and ROI

• Is investing in AI accounting tools really worth it for small businesses?

• What is the average cost of AI bookkeeping software in 2025?

• Are there AI tools under $30/month that can replace multiple finance apps?

• How can small business owners measure ROI after adopting AI tools?

• Which apps provide the best free trials or affordable subscription tiers?

🚀 Productivity and Business Growth with AI

• How do AI finance tools help small business owners scale operations faster?

• Can AI help reduce late payments and unpaid invoices?

• How can startups use AI-powered accounting automation to stay competitive?

• What are the best AI apps for time-saving financial management?

• How can AI free up time for strategic planning instead of manual tasks?

🌍 Future of AI in Finance and Accounting

• Will AI replace accountants or finance professionals in the next decade?

• What new AI trends are shaping financial automation in 2025 and beyond?

• How will voice-activated AI accounting assistants change bookkeeping?

• What’s next for AI in business finance between predictive analytics and full automation?

🪙 For Freelancers and Solopreneurs

• Can freelancers use AI apps for client invoicing and financial planning?

• What are the best AI tools for freelance accounting and budgeting?

• How can AI help freelancers track expenses across multiple clients?

• Are there low-cost AI finance apps tailored for individual professionals?

• Which AI apps integrate best with QuickBooks, Xero, or Wave Accounting?

• How to connect AI forecasting tools to Google Sheets or Excel?

• Are there AI Chrome extensions that help track expenses automatically?

• How do AI finance tools connect with CRM or e-commerce platforms like Shopify?

Let’s be real: managing money isn’t optional. It’s the lifeblood of your business.

That means:

• Endless spreadsheets

• Costly errors

• Hours lost every single week

AI accounting software flips the script. Here’s how:

- Bookkeeping: Auto-enters transactions, categorises expenses, and reconciles accounts. So, no typing required.

- Invoicing: Sends automatic reminders, flags clients likely to pay late, and even schedules vendor payments.

- Forecasting: Turns your past financial data into clear, actionable projections.

- Fraud detection: Spots weird activity the moment it happens, potentially saving you thousands.

- Tax and audits: Cuts prep time from weeks down to hours.

👉 Imagine getting 10+ hours back every week; not for more admin, but for actual growth.

That’s the real ROI of AI.

If you’re just starting with AI, we recommend beginning with these 6 Must-Have AI Finance Apps for Small Businesses.

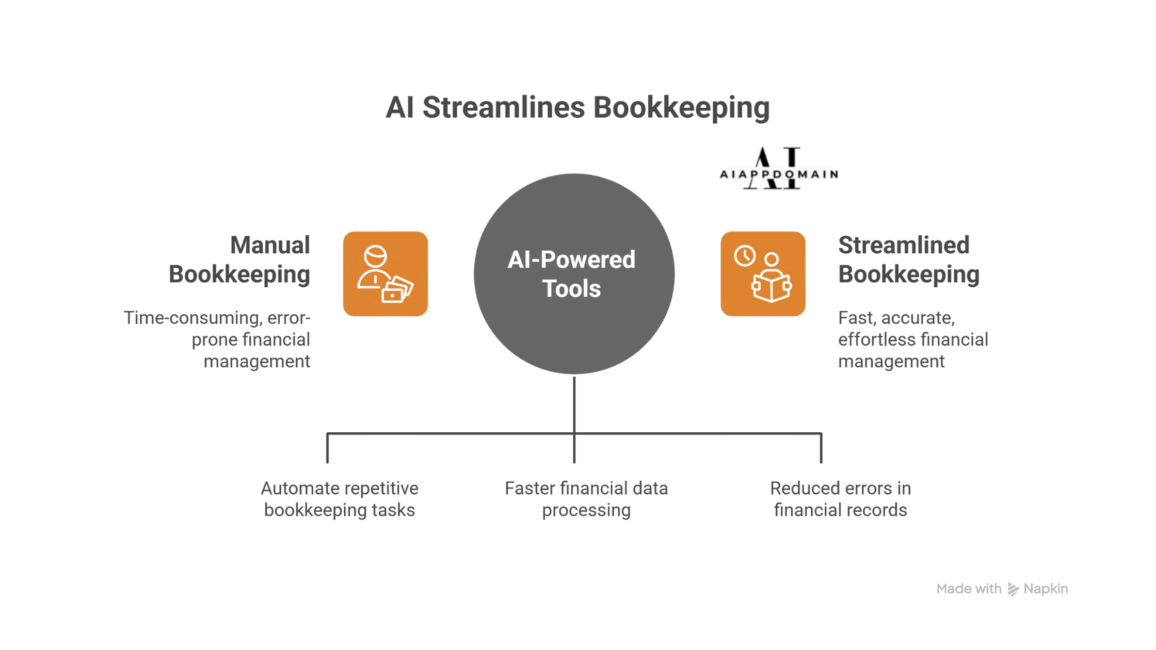

Let’s start with the foundation of every financial system: bookkeeping

Manual spreadsheets? They’re officially retired.

Today’s AI-powered tools make bookkeeping so fast and accurate that it practically disappears from your to-do list.

And this isn’t just about convenience. Bookkeeping mistakes cost small businesses tens of billions annually in lost productivity, errors, and penalties. AI slashes that risk.

👉 Case Study: Priya, a solo consultant, used QuickBooks AI to auto-categorise over 10,000 transactions a month.

Result? She saved 15 hours every week. She now spends growing her advisory practice instead of fixing receipts.

AI Bookkeeping Apps

Top bookkeeping apps and expense tracking apps:

Tool | Pricing | Features | Pros | Best for |

Custom pricing | Auto-categorizes expenses, forecasts cash flow | Trusted brand, integrations | SMBs & consultancies | |

From $15/mo | Bank reconciliations, tax filing | Great for accountants | SMEs & startups | |

From $12/mo | Invoicing, time tracking | Simple interface | Freelancers | |

From $15/mo | CRM integration, automation | Low cost, scalable | Startups on budget | |

From $6/mo | Receipt scanning, reports | Mobile-first | Teams with frequent expenses |

Bookkeeping is great, but every business owner’s headache is still getting paid on time.

Apps for Invoicing and Accounts Payable

That night with the chai cups? It doesn’t have to be your norm. With the right AI tools, your finances can finally work for you—not against you.

Late payments don’t just annoy you; they choke your cash flow. AI turns invoicing from reactive to proactive.

Why This Matters

Let’s get real: Effective cash flow management remains a top challenge for small businesses, with delayed payments and poor forecasting ranking among the biggest causes of financial failure. And one of the biggest culprits? Invoices that sit unpaid for weeks or vanish into client inboxes forever.

AI fixes that. It doesn’t just send invoices; it chases them, predicts who’ll pay late, and even automates what you owe vendors.

- Sage Business Cloud: Flags risky clients before you invoice them + auto-sends gentle reminders.

- Melio: Automates vendor payments so you never miss a bill, and keeps your supplier relationships smooth.

- Zoho Invoice: Handles recurring invoices, late notices, and payment links—all on autopilot.

- Wave: 100% free invoicing and payment processing. Perfect if you’re a solopreneur, keeping costs at zero.

👉 Case Study: A small retail shop used Melio to automate payment reminders and cut late payments by 40% in under two months.

With invoices managed, the next challenge is planning the future of your finances.

Want to see the top apps designed specifically for bookkeeping? Read our detailed guide on the Best AI Bookkeeping Tools in 2025.

Forget guessing next quarter’s numbers. AI looks at your past finances and market trends, and then gives you clear and actionable forecasts.

No crystal ball needed. Just data that helps you plan, not panic.

👉 Case Study: A SaaS startup used Fathom to spot a 30% cash shortfall six months in advance. They adjusted budgets early, avoided layoffs, and rode out an industry crash while competitors folded.

What’s Next?

Once your invoices are flowing and your forecasts are clear, you’re not just surviving. You’re strategically positioned to grow.

Fraud isn’t just a “big company” problem.

According to the ACFE 2024 Report, organizations on average lose about 5% of their revenue annually to occupational fraud.

The scary part? Much of it goes unnoticed until it’s too late.

AI for fraud detection changes that. It spots red flags humans miss: weird payment patterns, duplicate invoices, or payroll anomalies, in real time.

Tools that stop fraud before it hurts:

- Feedzai: Flags suspicious payment activity the moment it happens.

- SAP Analytics Cloud: Catches payroll fraud, like fake employees or inflated hours.

- Darktrace: Detects insider threats and cyber risks before data leaks.

- Sift: Protects your online store from fake orders and chargeback scams.

👉 Real result: A mid-sized manufacturer uncovered a $20,000 payroll fraud attempt—all thanks to an alert from SAP Analytics Cloud.

Apps for Tax Compliance and Audit Automation:

Let’s be honest: tax season feels like a part-time job.

AI cuts through the chaos—auto-finding deductions, tracking deadlines, and prepping audit-ready files.

Let’s be real: managing money isn’t optional. It’s the lifeblood of your business.

That means:

• Endless spreadsheets

• Costly errors

• Hours lost every single week

AI accounting software flips the script. Here’s how:

- Bookkeeping: Auto-enters transactions, categorises expenses, and reconciles accounts. So, no typing required.

- Invoicing: Sends automatic reminders, flags clients likely to pay late, and even schedules vendor payments.

- Forecasting: Turns your past financial data into clear, actionable projections.

- Fraud detection: Spots weird activity the moment it happens, potentially saving you thousands.

- Tax and audits: Cuts prep time from weeks down to hours.

👉 Imagine getting 10+ hours back every week; not for more admin, but for actual growth.

That’s the real ROI of AI.

Let’s start with the foundation of every financial system: bookkeeping.

- TurboTax AI: Finds every deduction you qualify for + tracks compliance.

- H&R Block AI: Double-checks your return for accuracy (no more panic edits).

- Drake Tax: Slashes filing time, 50+ hours saved for many small firms.

- Workiva: Automates complex SEC or nonprofit filings.

- TeamMate+: Turns weeks of audit prep into a few focused hours.

👉 Case Study: A nonprofit used Workiva to cut audit prep time by 70%, freeing up staff to focus on their mission, not paperwork.

Beyond accounting, businesses now use AI to grow wealth.

AI isn’t just about protecting your money. It’s about growing it. Today, tools once reserved for Wall Street are in the hands of freelancers, founders, and small teams.

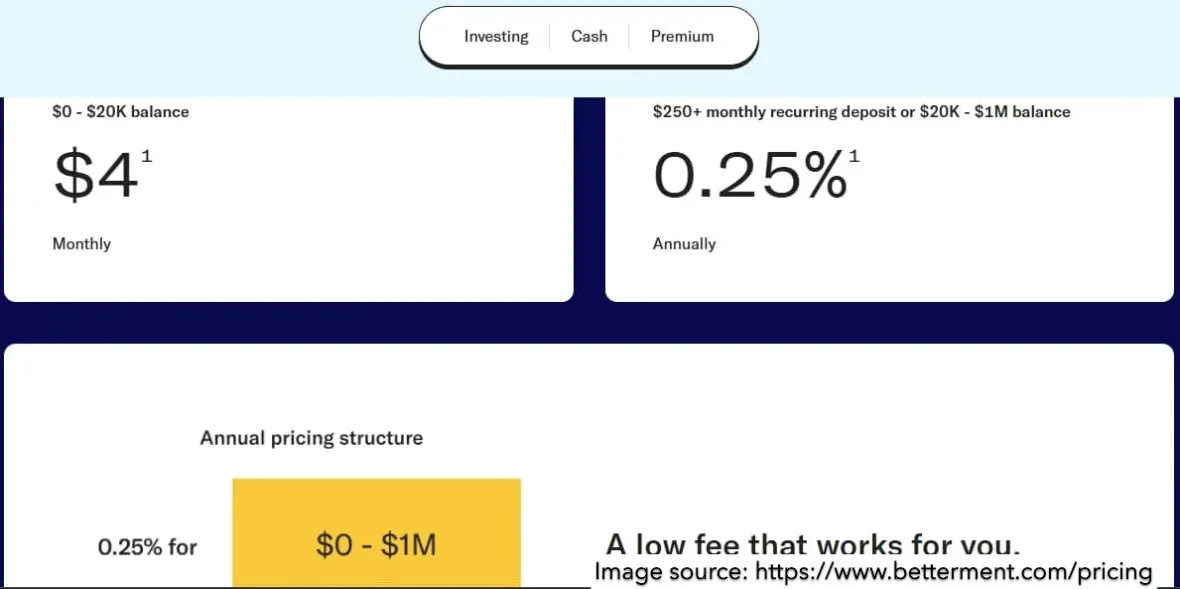

- Betterment and Wealthfront: Set-and-forget robo-advisors that invest your business surplus wisely.

- TrendSpider: Spots market patterns so you can time investments smarter.

- Pocketsmith: Blends personal and business cash flow into one clear forecast, so you know what you can safely reinvest.

This isn’t speculation. It’s strategy, which is powered by data, not gut feeling.

AI in small business finance sounds great, but real businesses face real hurdles. Here’s how to navigate them:

1. Data Security

Question: “What if my data gets hacked?”

Problem: Businesses worry about breaches.

Fix: Use SOC 2 or ISO-certified apps (e.g., Zoho and FreshBooks). They meet enterprise-grade security standards, even for solopreneurs.

2. App Overload

Question: “I’m drowning in apps already!”

Problem: Too many apps = chaos.

Fix: Start with just 1–2 core tools. Master them. Add more only when you need to.

3. Team Resistance

Question: “My team’s scared AI will replace them.”

Problem: Staff fear replacement.

Fix: AI is their assistant, not their replacement. It handles the boring stuff. So, they can do more meaningful work.

These aren’t hypotheticals. Real small businesses are winning with AI right now:

- Raj’s e-commerce store used Melio to automate payment reminders and cut late payments by 50%.

- A consulting firm slashed bookkeeping from 20 hours to just 2 hours per month with QuickBooks AI.

- A nonprofit organisation saved 70% of audit prep time using Workiva. They are redirecting energy back to their cause.

AI isn’t magic. But in 2025, it’s the closest thing small businesses have to a financial co-pilot; one that never sleeps, never misses a detail, and always has your back.

Curious how automation can save hours of manual work? Don’t miss our article on AI Accounting Automation Apps.

AI isn’t here to replace accountants.

It’s here to replace stress, costly mistakes, and hours lost to busywork.

Think of it like this:

✅ Start simple: Pick one bookkeeping tool like QuickBooks or Zoho Books. Get your foundation clean.

✅ Scale smart: Add forecasting tools (like Fathom or LivePlan) once you’re ready to plan ahead.

✅ Protect & grow: Layer in fraud detection and tax automation as your business matures.

The sooner you bring AI into your financial workflow, the faster your books stop feeling like chaos and start becoming your secret weapon.

Because in 2025, the most competitive small businesses aren’t the ones working the hardest. They’re the ones working smarter.

-

1. Can AI handle complex financial tasks?

Yes. AI tools like QuickBooks AI and Zoho Books can process thousands of transactions in seconds, automatically categorize expenses, and even generate detailed reports. They don’t replace your accountant. They give them cleaner data to work with.

-

2. What’s the cheapest AI bookkeeping tool?

Wave Accounting is free, offering basic bookkeeping and invoicing powered by automation. For low-cost premium options, Zoho Books (from $15/month) and Expensify (from $6/month) are among the most affordable.

-

3. Are AI tools good for self-publishing or freelancers?

Absolutely. Tools like FreshBooks simplify invoicing and expense tracking for freelancers, while apps like Jasper or Copy.ai (for content) integrate seamlessly with accounting software.

-

4. How can AI simplify day-to-day accounting?

AI removes manual entry. For example, Expensify lets you snap a receipt, and it automatically logs the amount, date, and category. Reconciliations that once took hours now take minutes.

-

5. How to stop chasing late payments?

Apps like Melio and Sage Business Cloud automatically send reminders to clients, flag risky customers, and even automate vendor payments.

-

6. Can AI predict my company’s cash flow?

Yes. LivePlan and Fathom analyze your historical revenue and expenses, then simulate scenarios (like “What if sales drop by 20%?”). This helps you prepare for challenges in advance.

-

7. How does AI prevent financial fraud?

AI uses anomaly detection. Tools like Feedzai and Darktrace track transactions in real time and alert you if they spot unusual behavior (e.g., an unexpected $20,000 payroll entry).

-

8. Can AI handle tax preparation?

Yes. Apps like TurboTax AI and H&R Block AI guide you through filing, flag missed deductions, and ensure compliance with tax law updates. Accountants also use Drake Tax for automation.

-

9. How can AI simplify financial audits?

Tools like Workiva organize data, generate audit-ready reports, and highlight inconsistencies automatically. Nonprofits using Workiva have cut audit prep time by 70%.

-

10. What smart AI accounting tools can streamline my business finances?

- QuickBooks AI → bookkeeping + invoicing.

- Zoho Books → affordable, scalable accounting.

- FreshBooks → simple invoicing for freelancers.

- Xero AI → accountant collaboration + tax support.

-

11. How can AI protect my business from financial fraud?

Use specialized tools:

- Feedzai → online payment fraud.

- SAP Analytics Cloud → payroll + expense anomalies.

- Sift → eCommerce fraud.

-

12. How can AI enhance my financial forecasting accuracy?

By analyzing data trends, AI tools like Dryrun and Forecastr provide realistic revenue projections and “what-if” models. This improves budgeting and fundraising conversations.

-

13. What are the best AI tools for automating bookkeeping in 2025?

- QuickBooks Online Advanced

- Zoho Books

- Xero AI

- Dext Prepare (receipt + invoice matching)

-

14. What AI apps reduce tax compliance errors?

TurboTax AI, H&R Block AI, and Drake Tax use automation and machine learning to catch mistakes early, reducing costly penalties.

-

15. In what ways does AI improve accounts payable workflows?

AI tools like AvidXchange and Melio automate invoice capture, approvals, and payments.

-

16. What are free AI accounting tools for startups?

- Wave Accounting (bookkeeping + invoicing)

- ZipBooks (expense tracking)

- ChatGPT (free tier) for generating reports/explanations

-

17. Is AI safe for managing business finances?

Yes, if you choose trusted apps. Look for tools with SOC 2, GDPR, or ISO 27001 certifications. Many apps also offer encryption to protect sensitive data.

-

18. Do I need tech skills to use AI apps?

Not at all. Most AI finance apps are user-friendly. For example, FreshBooks and QuickBooks are designed for non-tech business owners.

-

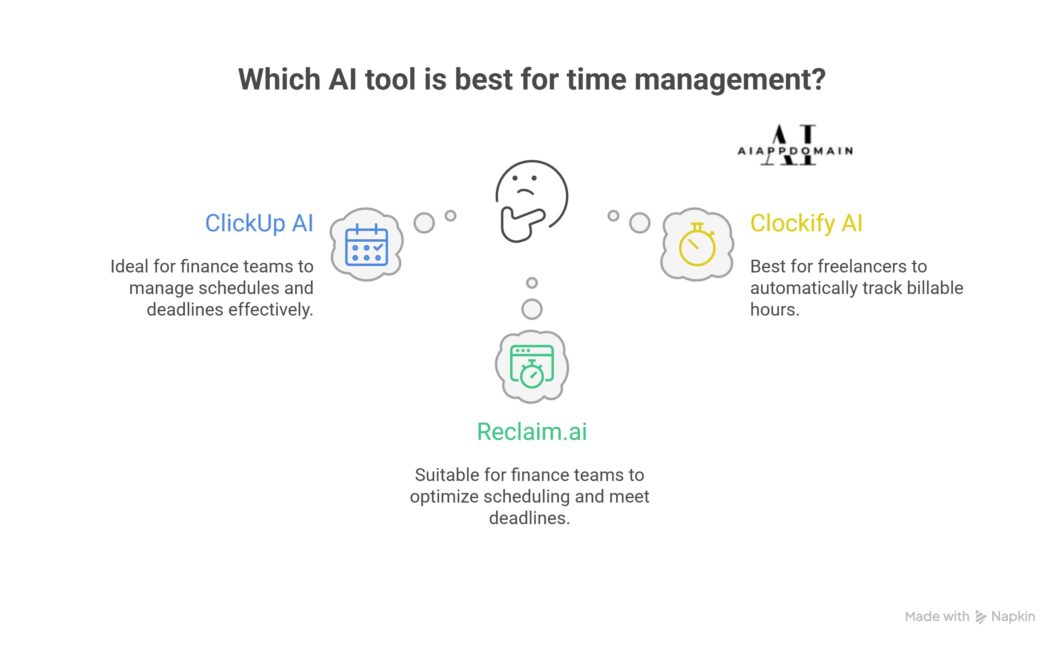

19. Which AI tool is best for time management?

For finance teams, ClickUp AI and Reclaim.ai handle scheduling and deadlines. For freelancers, Clockify AI tracks billable hours automatically.

-

20. How can AI help me find new clients (for freelancers)?

Platforms like Apollo.io and Hunter.io use AI to identify leads, enrich contact data, and predict conversion likelihood.

-

21. How do I stay competitive as a freelancer with AI?

Adopt tools your competitors don’t. Use Jasper for content, QuickBooks SE for accounting, and Upwork Skills Index to track rising freelance niches.

Here’s a quick guide to the financial and AI jargon we used:

- Accounts Payable (AP): Money a business owes to suppliers.

- Accounts Receivable (AR): Money owed to a business by clients.

- AI (Artificial Intelligence): Machine-driven decision-making that mimics human learning.

- Anomaly Detection: Identifying unusual or suspicious financial patterns.

- Audit Preparation: Organizing financial records for compliance checks.

- Automated Bookkeeping: Software that records transactions without manual entry.

- Cash Flow: Movement of money into and out of a business.

- Cash Flow Forecasting: Predicting future inflows/outflows of money.

- Compliance Reporting: Reports to prove adherence to legal/industry rules.

- Data Security: Protecting digital information from theft or corruption.

- Expense Management: Tracking and controlling company spending.

- Financial Forecasting: Using data to predict revenues and expenses.

- Financial Fraud: Deceptive practices to steal or misuse money.

- Hyper-Automation: Combining AI + automation to optimize workflows.

- Invoice Chasing: Reminding clients about overdue payments.

- Invoicing: Billing clients for goods/services.

- ISO 27001: International standard for data security.

- Machine Learning (ML): AI that improves through training and experience.

- Manual Bookkeeping: Recording transactions by hand or spreadsheets.

- Predictive Analytics: Using past data to predict future outcomes.

- Real-Time Data Analysis: Processing data as it arrives for instant insights.

- Reconciliation: Matching financial records to ensure accuracy.

- Tax Compliance: Adhering to laws when filing and paying taxes.

- https://quickbooks.intuit.com/ai-accounting/

- https://www.xero.com/accountant-bookkeeper-guides/ai-in-accounting

- https://www.freshbooks.com

- https://www.zoho.com

- https://use.expensify.com/

- ttps://www.sage.com

- https://meliopayments.com

- https://www.zoho.com

- https://www.waveapps.com

- https://www.fathom.ai

- https://www.floqast.com

- https://www.dryrun.com

- https://www.forecastr.co

- https://www.liveplan.com

- https://www.feedzai.com

- https://www.sap.com

- https://www.darktrace.com

- https://sift.com

- https://turbotax.intuit.com

- https://www.hrblock.com

- https://www.drakesoftware.com

- https://www.workiva.com

- https://www.wolterskluwer.com/en/solutions/teammate/teammate-audit

- https://www.betterment.com

- https://www.wealthfront.com

- https://trendspider.com

- https://www.pocketsmith.com

Look, we’re big fans of AI accounting tools (obviously). They save time, reduce errors, and give you superpowers you didn’t know you needed. But before you go all-in, here’s what you need to know:

✅ We’re not accountants or tax advisors.

The info in this post is for general guidance only, not professional financial, legal, or tax advice. Every business is different. What works for one freelancer might not fly for another. Always consult a licensed accountant, CPA, or tax pro before making big financial moves (especially come tax season).

✅ AI is smart, but not psychic.

These tools are amazing at automating tasks and spotting patterns, but they’re not perfect. Mis-categorized expenses? Overlooked deductions? It happens. Always review your books and reports. AI is your co-pilot, not your autopilot.

✅ Pricing & features change. Fast.

We’ve done our best to reflect current pricing and features as of [Insert Month/Year; e.g., “April 2025”], but SaaS tools update constantly. Always check the official website for the latest plans, terms, and fine print.

✅ Affiliate links? Maybe.

Some links in this post may be affiliate links. If you sign up through them, we might earn a small commission (at no extra cost to you). We only recommend tools we’ve tested, trust, and believe will actually help you. No shady promotions here.

✅ Your data, your responsibility.

When you connect bank accounts or upload financial data to any tool, you’re trusting them with sensitive info. Read their privacy policy. Enable 2FA. Back up your data. Better safe than sorry.

📌 Bottom line?

AI accounting tools are game-changers, but they work best when paired with your judgment (and maybe a human bookkeeper or CPA). Use them wisely, review often, and never stop asking questions.

Got doubts? Talk to a pro.

Got receipts? Let AI sort ‘em.

Got peace of mind? That’s the goal.

When I first heard about AI for finance, I was unconvinced.

Can software really handle something as nuanced and personal as my business finances?

Then I tried QuickBooks AI. Then Melio. Then a few more.

And everything changed.

I stopped drowning in receipts and reconciliation.

I stopped dreading month-end.

And I started spending time on what actually moves the needle: strategy, clients, and growth.

AI didn’t take over my finances—it clarified them.

It gave me back hours every week and the confidence to make smarter decisions.

This site is my way of paying that forward.

If you’ve ever stared at a spreadsheet at 11 p.m., stressed over an invoice, or wondered, “Is there a better way?”—you’re in the right place.

Let’s make finance smarter, simpler, and yes—a little more human.

Together.

— Barnali

Founder & Content Creator, AIAppDomain.com

The more we talk about AI in plain, human terms, the more real people can actually use it (not just tech folks).

And if you’ve tried any of the tools I mentioned, I’d love to hear how it went.

Drop a comment or shoot me a message at AIAppDomain.com. Your experience could be the nudge another founder needs to work smarter with AI.

Let’s keep learning. Keep testing. Keep growing.

One AI app at a time. 🌱

Stat:

Stat: