AI apps for finance and accounting manage money; automate things like bookkeeping, security processes, and transaction monitoring; and provide suggestions for optimizing decision-making capability. Therefore, these apps play an important role in ensuring our financial well-being in the years to come.

Before making any big financial decisions, people should be aware of the risks related to the application of AI-based financial solutions and the limitations of these AI-driven financial apps.

On this page, I have curated 6 AI apps for finance and accounting. From intelligent investment analysis to automated budgeting, I discover powerful tools that use artificial intelligence to optimize our financial strategies. You can also revolutionize your approach to finance with cutting-edge AI technology.

Table of Contents

Toggle6 Best AI Apps for Finance and Accounting for Small Businesses

If you are looking for answers to the following questions, here are 6 AI-powered apps that can assist you in your small businesses.

- How is AI Reshaping the Financial Sector?

- How does AI improve accounts payable workflows?

- What are the 6 best AI tools for small business accounting?

Betterment

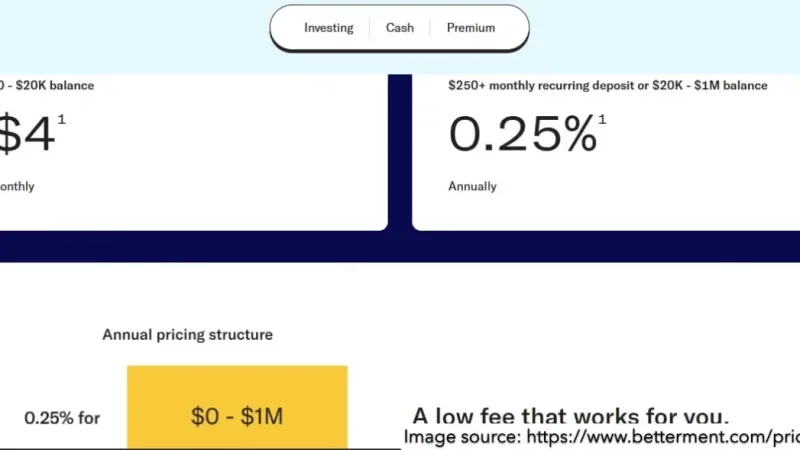

Betterment helps manage investments based on risk tolerance and goals. See the below image for price (as of 31.5.2025):

Wealthfront

Wealthfront is one of the best AI apps for finance that helps in saving and investing money. See the below image for price (as of 31.5.2025):

The global financial technology platform Intuit helps manage our finances with AI accounting software TurboTax, Credit Karma, QuickBooks, and Mailchimp. See the below image for price of TurboTax (as of 31.5.2025):

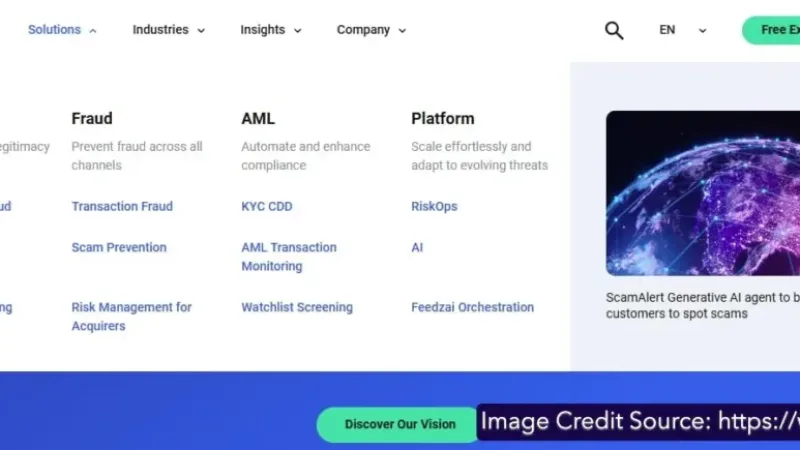

AI fraud detection for finance and security app Feedzai detects fraudulent transactions and protects customers from credential theft across every interaction. See the below image for price (as of 31.5.2025):

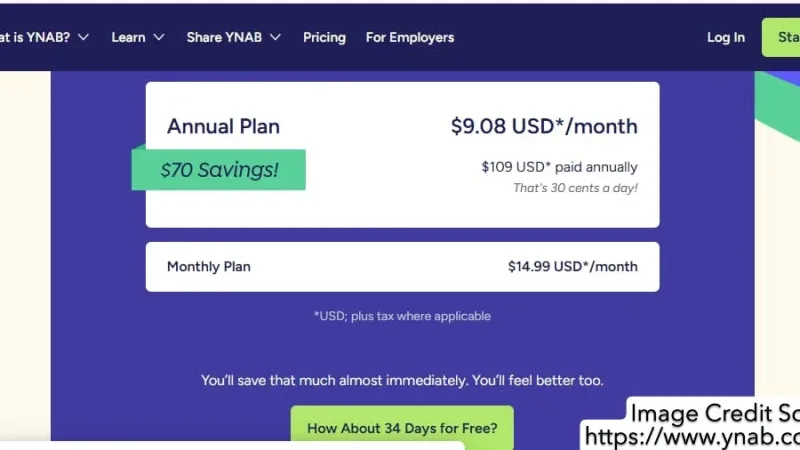

Budgeting and personal finance AI-driven app YNAB helps pay our bills and take control of our money so that we can build a secure financial future. See the below image for price (as of 31.5.2025):

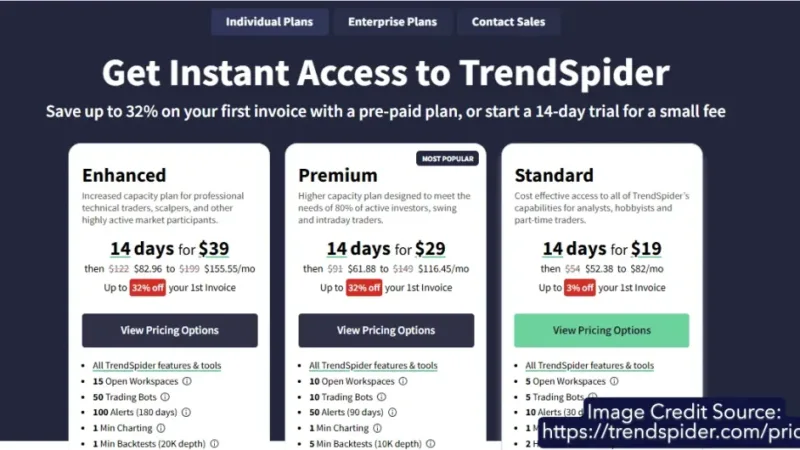

Stock and market analysis AI-driven app TrendSpider helps us plan our trade like a pro. See the below image for price (as of 31.5.2025):

Summary of Findings

- Betterment and Wealthfront are robo-advisors with similar pricing (0.25% annual fee) and AI-driven investing, but Betterment offers no minimum balance and access to human advisors, while Wealthfront provides advanced tax strategies and DIY investing options.

- TurboTax excels in tax preparation with AI automation, ideal for individuals and small businesses, with pricing that scales based on return complexity.

- Feedzai is an enterprise solution focused on fraud detection making it distinct from the others in scope and pricing.

- YNAB is a budgeting app emphasizing financial discipline through zero-based budgeting, with a subscription model and strong educational resources.

- TrendSpider targets active traders with AI-powered technical analysis, offering advanced tools but at a higher price point compared to consumer-focused apps.

These six apps are great for getting started, but if you’re ready to go deeper, head over to our full guide on the Best AI Apps for Finance & Accounting in 2025.

Frequently Asked Questions (FAQs)

Which app is best for tracking my expenses?

Are these apps free to get started?

Can someone new to finance use these easily?

Will these save me time with my finances?

Are my financial details safe with these apps?

How do I choose the right app for my money needs?

Can I use these on my phone or computer?

Do I need special skills to start?

How do these apps help with tax prep?

Can these connect with my bank account?

What’s the best way to learn these tools?

Do these apps offer support if I’m confused?

Disclaimer

This blog post is meant to inform and educate in a general sense. It does not replace tailored advice from legal, financial, or technical experts.

A Few Important Notes:

- Examples given (like chatbots or predictive analytics) show possible uses of AI, not guaranteed results. Every business is different.

- Stats and trends come from credible sources, but AI evolves fast. What is true today might shift tomorrow—always double-check the latest updates.

- Ethics and compliance are touched on briefly (e.g., privacy concerns and workforce impact), but this is not legal advice. When adopting AI, consult experts to stay compliant.

- Tools mentioned (e.g., cloud platforms, chatbot software) are for context, not recommendations. Research thoroughly to find what works for your needs.

- Success with AI depends on execution: the quality of your data, how well you implement solutions, and how prepared your team is.

By reading this, you agree:

- Any use of AI strategies or tools is your responsibility.

- The author and publisher are not liable for decisions made based on this content.

- Links to external sites are for convenience only—we do not vouch for their content.

- This disclaimer may be updated without notice. Questions? Reach out at www.aiappdomain.com.

Think of this post as a starting point, not a roadmap. Always adapt ideas to your unique situation!

Author's Note

Welcome to aiappdomain.com! I’m Barnali, and if you’ve dropped by, you’re probably wondering who’s behind “Transform Your Finances: 6 Essential AI Apps for Finance & Accounting.” Let me share a bit about myself!

I’m a seasoned copy editor with over 25 years in the publishing world, specializing in STM journals and books. My journey has been a vibrant path through words—polishing manuscripts, journals, and academic papers with a love for detail, clear communication, and spot-on accuracy. Whether I’m tweaking a challenging paper or lifting a book to its finest form, that’s where I thrive.

So, why am I diving into AI apps for finance and accounting? Here’s the tale: I’ve started using this technology for my own freelancing projects, and it’s helped my small business flourish by keeping my finances on track. Working with these tools feels like turning a jumbled budget into a clear financial roadmap—bringing order to the chaos. With my years of experience, I’m excited to stand with freelancers and small business owners like you, offering practical guidance to succeed in 2025. Here on this website, I’m sharing my own story to lead the way, and you can count on me to bring the insight and trustworthiness to make aiappdomain.com your go-to resource!

Please see the Author page.

Reader's Note: Let's Talk Financial Control

Managing finances can feel like a tightrope walk—every decision matters, and every mistake carries weight. But with the right AI tools, what once felt chaotic suddenly feels calm and completely under control. These apps deliver clarity, not just calculations.

So, which AI finance tool made the single biggest difference in your daily confidence? Was it the one that locked down expenses or the forecasting tool that let you plan for what’s ahead?

Share your favorite in the comments! Your insight might help another business owner finally find their financial balance.

The Takeaway: Financial control isn’t magic. It starts with one smart decision.

If you enjoyed this list of AI apps for finance, do not forget to share it with your friends or colleagues who might find it useful too. Let us spread the knowledge and make smarter, faster solutions accessible to everyone!

Are you curious about other AI-powered apps? Swing by my website to explore more!