Hey there! I am Barnali; your slightly-obsessed-with-details, chai-sipping, solopreneur friend from India.

It’s 7:29 PM on a Monday, 18 September 2025, and if you’re here, chances are you’re tired of spreadsheets that look like abstract art.

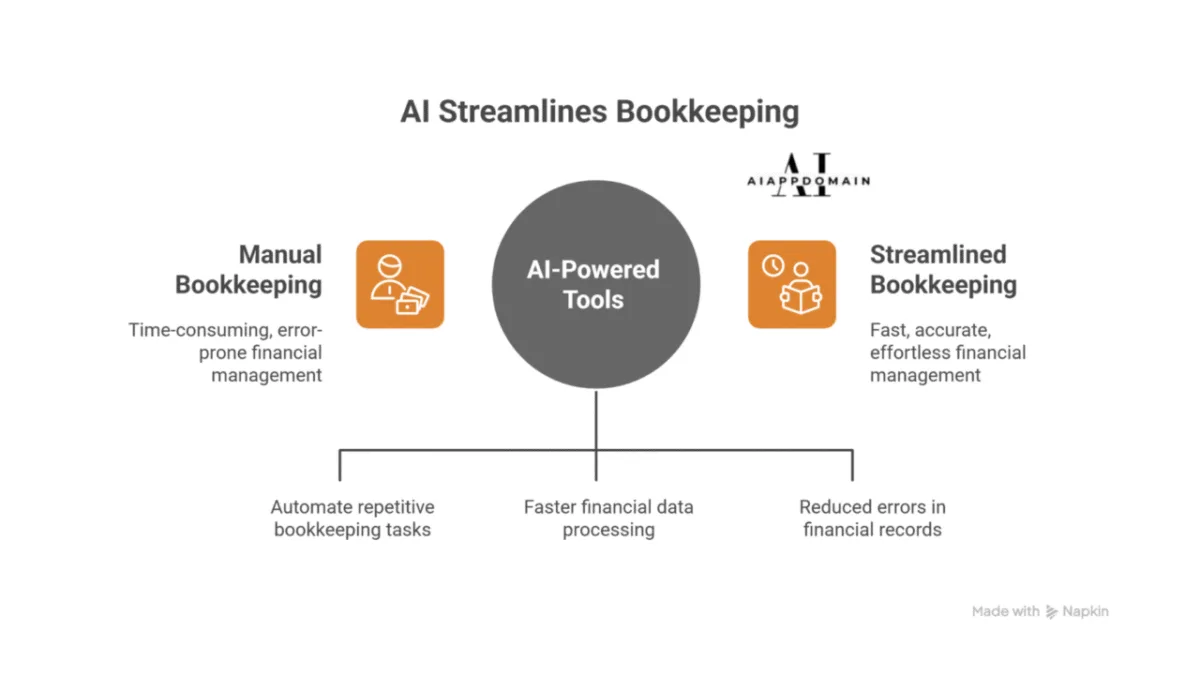

After years of juggling freelance gigs, chasing payments, and crying over GST returns (yes, I’ve been there), I discovered something magical: AI bookkeeping tools that don’t just automate; they adapt to YOU.

No finance degree? No problem.

No time? Even better, because these tools give it back to you.

I tested them. I broke them. I cried over them (in a good way). And now? I’m handing you the golden keys and a few secret research-backed upgrades even the toolmakers don’t shout about.

Look, 2025 isn’t just another year. It’s the year AI stops being “cool tech” and starts being your financial co-pilot. Here’s what changed that I didn’t even know until I dug deeper:

✅ AI now learns your quirks: Not just “Meals & Entertainment,” but “Barnali’s Monday Motivation Chai + Samosa Splurge.”

✅ Real-time regulatory updates: Indian GST? US Sales Tax? EU VAT? AI tools now auto-update rules so you don’t get penalized.

✅ Voice-to-bookkeeping: Yep. Talk to your app. “Hey, log ₹850 for chai with the client at CCD.” Done. (More on this below!)

✅ Predictive cash flow + scenario planning: What if you delay invoicing by 3 days? What if Client X pays late? AI shows you the ripple effect.

✅ Multi-currency + multi-language support: Global freelancing? AI now auto-converts, auto-translates receipts, and auto-tags cross-border expenses.

This isn’t automation.

This is financial empathy.

🏆 5 Best AI Bookkeeping Tools for Small Businesses in 2025 (Tested + Tweaked by Me)

🧾 QuickBooks Online for When Your Business is Growing (And You’re Tired of Doing Everything Yourself)

Best for: Small business owners who want things to just work without hiring a full finance team or losing sleep over receipts.

Here’s how it helps you breathe easier:

🔹 Automated Expense Categorization: It sorts your expenses automatically.

Used to tag every chai bill, Uber ride, and office supply run? Me too. Now, QuickBooks watches what you do, remembers your habits, and starts doing it for you. Receipt from CCD? → “Client Meeting.” Uber at 8 PM? → “Business Travel.” And if it gets it wrong? You nudge it once, and it remembers. No PhD required.

🔹 Smart Cash Flow Forecasts: It warns you before cash runs low.

Remember that time you almost ordered new inventory only to realize your bank balance was gasping? QuickBooks now gently taps you on the shoulder: “Hey, if Client X pays late, you’ll be ₹12,000 short next week. Want to send a reminder?” It doesn’t predict the future, it just connects the dots you’re too busy to see.

🔹 AI-Driven Invoice Tracking: It chases payments politely.

Invoices sent? Check. Reminders scheduled? Check. Real-time updates on who paid, who’s dragging their feet? Double check. I’ve seen payments land five days faster just because the system nudged clients at the right time; no awkward texts from me needed.

💰 Pricing? Let’s Keep It Real

QuickBooks now starts at $38/month (that’s about ₹3,200) for the Simple Start plan.

→ Need more? Essentials, Plus, and Advanced add fancier automations (like multi-user access or inventory tracking).

→ But honestly? Start Simple. You can always upgrade when your business outgrows your spreadsheet.

📖 My Story (Because I’ve Been in Your Shoes)

There was a time, not long ago, when Sunday nights meant me, my laptop, and 17 unsorted transactions. “Was that Uber for work or for my sister’s birthday?” “Is this coffee a ‘team meeting’ or ‘personal splurge’?” Ugh.

Now? QuickBooks quietly handles 90% of it. It knows “CCD + Tuesday afternoon = Client Pitch.” It knows “Uber + 7 PM = Business Travel.” And if it’s unsure? It asks once. Then it remembers. I’ve gained back 2–3 hours every week. That’s movie nights. Walks. Naps. Actual life.

☕ How to Automate Expense Categorization in QuickBooks

How to Set It Up (My 5-Minute, No-Stress Method)

Don’t overthink this. Seriously. Follow the steps:

- Go to Banking > Link Account: Yes, your Indian bank works (HDFC, ICICI, SBI—all play nice).

- Toggle on Auto-Categorize: It’s already switched on in 2025 versions (thank you, QuickBooks).

- Peek at what it suggests: “Meals,” “Travel,” “Office Supplies.” Feels right? Approve. Feels off? Tap and rename it.

- Teach it to your regulars: “Every Uber from this vendor = Business Travel.” Set it once. Forget it forever.

- Once a month, give it a quick scan. 9 out of 10 transactions? Already perfect. Fix the odd one. Done.

💡 Pro Tip: My Little Secret (That Makes All the Difference)

The magic doesn’t happen overnight, but it does happen fast.

The more you gently guide it in the beginning, the smarter it gets (e.g., “No, this isn’t ‘Entertainment,’ it’s ‘Team Lunch’”). By Month 2, it’s basically reading your mind. By Month 3? You’ll forget you ever did this manually.

Think of it like training your favorite café barista:

→ First time: “I want masala chai, extra ginger, no sugar.”

→ Third time: They see you walk in and start brewing.

That’s QuickBooks bookkeeping app in 2025.

Quiet. Helpful. And finally, on your side.

Best for: Freelancers, creatives, solopreneurs, and small agencies who just want to get paid without turning into a nagging invoice-bot.

Bookkeeping app FreshBooks acts like a well-trained assistant who knows exactly when to nudge a client and when to leave them alone.

Starts at $20/month (Lite plan: good for up to 5 clients).

Need more? Plus plan ($20/month; yes, same price!) handles 50 clients.

Going big? Premium unlocks unlimited clients; no ceiling, no stress.

And hey! Keep an eye out. They often drop seasonal discounts around Diwali or New Year. I snagged 30% off last November. I felt like a little Diwali bonus from the universe.

🧾 How FreshBooks Automates Payment Chasing

It’s not magic. It’s just really, really thoughtful design built by people who’ve clearly been freelancers themselves.

✅ Automated Recurring Invoices and Payment Reminders: It sends reminders so you don’t have to.

Set it once: “Remind them 3 days before it’s due.” “Nudge again if it’s late.” “Final notice with a smiley if needed.” Clients get gentle taps. You get paid faster. No more “Oops, forgot!” texts. (Seriously, mine dropped by 80%.)

✅ AI Invoice Tracking: It remembers who pays when.

FreshBooks watches patterns. If Client A always pays on the 7th, it holds off on reminders. If Client B needs three nudges, it spaces them out; no spam, no annoyance. Just smart timing.

You see everything in one glance.

Dashboard = your financial mood ring.

🟢 Green = Paid (happy dance).

🟡 Yellow = Pending (maybe send a voice note?).

🔴 Red = Needs Action (time to pick up the phone; but at least you know).

✅ Multiple Payment Gateways: Clients can pay however they like.

Razorpay. PayPal. Stripe. UPI. Credit card. Bank transfer. The more options you give, the faster they pay. I added UPI last year; payments started landing same-day. Game changer.

✅ Client Information is Auto-Saved: No more typing client details over and over.

Enter their name, email, and GST number once. Next invoice? One click. Done. I used to copy-paste from a Notes file. Now? I don’t even think about it.

📖 My FreshBooks Win (No Brag, Just Relief)

Since I started using FreshBooks, my “payment anxiety” has basically vanished.

Last quarter, payments started coming in two days faster on average. Not because I changed anything, but because the system did.

Clients aren’t annoyed. I’m not stressed. And my evenings? Finally, mine again.

The dashboard is my new best friend. I open it while sipping my morning chai, and I know exactly where I stand. No spreadsheets. No sticky notes. Just… calm.

☕ How to Automate Invoices in FreshBooks

How to Set It Up (My 5-Minute Ritual)

Don’t overcomplicate this. It’s easier than ordering lunch online.

- Go to Invoices > Create New. Type the client’s name once. Forever saved.

- Flip on Auto-Reminders. Pick “Due Soon,” “Overdue,” and “Final Notice.” Customize the message, if you’re feeling fancy.

- Add payment options. I use Razorpay + UPI. Clients love it.

- Hit Send. Then close your laptop. Go water your plants.

- Peek at your dashboard later: green = victory, yellow = wait, red = gentle follow-up.

That’s it. No training. No tutorials. Just… done.

💡 Secret Hack (That Feels Like Cheating)

Type this into the invoice builder: “I design branding kits for eco-friendly startups.”

And boom. FreshBooks whips up a clean, professional, and branded invoice template with your colors, your logo, and your tone. No designer needed. I used this for a yoga studio client last month. She said, “Wow, this looks so you.” Mission accomplished.

🫶 Pro Tip: One Last Thing Just for You

If you’re nervous? Try it free for 30 days. No card needed upfront. Play with it. Test it. Break it.

And if it’s not your cup of chai? Full refund. No drama.

Their support team? Actually helpful. I once called with a GST field question at 8 PM and got a reply in 12 minutes. Human. Kind. No robots.

FreshBooks didn’t just change how I invoice.

It changed how I feel about getting paid.

No more dread. No more guilt. Just quiet confidence and more time for the work I actually love.

Best for: Businesses juggling 5+ clients, managing inventory, or quietly whispering “IPO?” to yourself in the mirror. (Go ahead. Dream big. I do.)

Why Switch from Spreadsheets?

Let’s be honest: When your revenue starts climbing, your old “just track it in Excel” system starts wheezing. Receipts pile up. Invoices get lost. Bank statements look like ancient scrolls no one can decipher.

That’s where Zoho Books steps in; not with fireworks, but with calm, quiet competence. Like that friend who shows up with tea and a spreadsheet when your life is falling apart. No drama. Just solutions.

📖 My “Aha!” Moment (No, Really—I Gasped)

There was a time, not long ago, when “bank reconciliation” meant me, my laptop, and three hours of squinting at the mismatched numbers on a Friday night. I’d miss dinner. I’d miss walks. I’d miss life.

Now? Zoho Books handles it in eight minutes.

I timed it. Then I closed my laptop, put on my walking shoes, and actually enjoyed my evening stroll guilt-free.

That’s not just an AI bookkeeping tool. That’s liberation.

🧠 What Zoho Books Actually Does (Without the Tech Babble)

✅ Automates Reconciliation: It doesn’t just match numbers; it watches them. Like a careful, slightly nerdy librarian who notices when two books have the same barcode.

✅ Flags Errors & Duplicates: It spots duplicate charges, like when your SaaS tool bills you twice because someone clicked “Subscribe” in a meeting haze.

✅ Inventory Tracking & GST Filing: It catches vendor typos (e.g., “ABC Supplies” vs “ABX Supplies”) before they turn into accounting nightmares.

✅ Real-Time Cash Flow Alerts: It flags sneaky bank fees or weird currency glitches that quietly drain your balance over months.

✅ Data Privacy: Built in India, Zoho Books does not sell your data or advertise in-app.

✨ And in 2025? It’s gotten even sharper.

Last month, it pinged me about a ₹15,200 error—a payment that posted twice because of a bank glitch. I didn’t even know to look. It did it quietly and efficiently like a guardian angel with a calculator.

☕ How to Set It Up (My “While-Waiting-for-Tea” Method)

Don’t overthink it. This is simpler than setting up a new phone.

- Go to Banking > Add Account. It works with SBI, HDFC, ICICI, and 100+ others worldwide.

- Flip on Auto-Fetch + AI Matching. It’s like giving Zoho permission to tidy up for you.

- Let it suggest matches. Nine out of 10 times, it’s spot-on.

- Click “Confirm” or “Edit Once” if something’s off. It learns from that single correction.

- Run it once a week. Walk away. Come back to peace.

That’s it. No tutorials. No headaches. Just… done.

Turn on “Cash Flow Alerts.”

It doesn’t nag. It doesn’t panic. It just whispers:

“Heads up! A big vendor payment is due tomorrow, and your balance is running low.”

Last Diwali, this alert saved me from an overdraft fee. I moved money from my savings, avoided the penalty, and still bought those extra sweets. Victory.

Zoho doesn’t believe in tricking you with “starting at” prices that triple when you need real features.

Here’s what you actually get AI for bookkeeping in 2025:

Free | ₹0 | For revenue under ₹41L: 1,000 invoices, GST, basic reports |

Standard | ₹1,250–₹1,650/month | Up to 3 users, bank reconciliation, and solid reporting |

Professional | ₹3,300–₹4,150/month | Up to 5 users, inventory, multi-currency, projects |

Premium | ₹5,000–₹5,800/month | Up to 10 users, vendor portal, budgeting, deeper analytics |

Elite | ₹10,000–₹12,500/month | Advanced inventory, Shopify sync, custom workflows |

Ultimate | ₹20,000–₹23,000/month | Full customization, in-depth analytics, and tailor-made modules |

Note: Prices vary slightly by country. If you pay annually, you save about 15–20%. Mobile app, client portals, and automation? Included in all paid plans.

Start free. Upgrade when you’re ready. No pressure.

Xero for When You Almost Made a Big Mistake (And Are So Glad You Didn’t)

Best for: Planners, worriers, dreamers, and anyone who’s ever stared at their bank balance and whispered, “Can I afford this?”

Starting at ~$29/month (price increases from October 2025 for Early, Growing, and Established plans; first month free trial available).

📊 How Xero Actually Helps You Plan (Without Needing a Finance Degree)

Visual Dashboard: You don’t need to be an accountant. You just need to be curious. Xero does the heavy lifting and shows you what matters in colors even your mom could understand.

🟢 Green = You’re good. Breathe easy.

🟡 Yellow = Pause. Think. Maybe wait a week.

🔴 Red = Action needed. Don’t ignore this one.

Here’s what you can do in plain, human terms:

✅ AI-Powered Forecasts: See what’s coming in (and going out) in next week, next month, or next quarter.

Pick 7 days. 30 days. 90 days. Xero pulls from your invoices, bills, and even payroll. It shows you the full picture. No guesswork.

✅ Scenario Modeling: Play “What If?” without risking real money.

Thinking of hiring someone? Losing a big client? Spending on a new laptop?

Drag a payment date. Tweak an invoice. Watch how it changes your cash flow.

It’s like a financial sandbox; safe, visual, and surprisingly fun.

✅ Quick Setup: It even knows about Diwali, Christmas, or monsoon slowdowns.

In 2025, Xero started weaving in local events and inflation trends. So, if your clients always pay late in December, or sales dip during the rains, it factors that in. Not magic. Just smart.

✅ 30/90 Day Outlook: Share it with your CA (or your business partner) in one click.

Export as PDF. Email it. Print it. No more “Can you explain this spreadsheet?” texts. They’ll actually say, “Wow, this is clear.”

Xero didn’t just help me avoid a mistake.

It changed how I think about money.

I don’t dread opening my books anymore.

I don’t panic before big decisions.

I don’t lie awake wondering, “Did I miss something?”

Instead?

I check my dashboard over morning chai.

I play with scenarios while waiting for client calls.

I plan—not with fear, but with clarity.

That’s the gift Xero gave me.

Not fancier reports.

Not smarter AI.

Just… peace.

And in 2025? That’s the rarest, most valuable thing of all.

Seriously, this takes less time than ordering lunch.

- Go to Business > Cash Flow Forecast. It’s right there, waiting.

- Pick your view: 7, 30, or 90 days (I live in 90-day mode. It gives me breathing room).

- Watch the chart build itself; its inflows (money coming in) vs outflows (bills, payroll, etc.).

- Want to test something? Drag an invoice date. Add a pretend expense. See what happens.

- Found something useful? Hit Export > PDF and send to your CA, partner, or future self.

Done. No tutorials. No stress.

Xero plays nice with others.

Use Gusto for payroll? Float for deeper forecasting? CashFlowFrog for investor-ready reports?

Xero connects. No drama. No extra logins. Just… more power, when you’re ready.

Best for: Freelancers. Side-hustlers. Solopreneurs. Anyone who’s ever muttered, “I’ll sort this later…” and then forgot where “later” went.

Starter Plan: ₹0 Forever

→ Unlimited invoices, estimates, bills, and bookkeeping entries

→ Accept online payments (small fee per transaction: 2.9% + $0.60 for cards, 3.4% + $0.60 for Amex)

→ Mobile app to invoice on the go

→ Dashboard to track cash flow + customers

→ Perfect if you’re just starting or keeping things lean

Pro Plan: ₹1,350/month (~$16) per business

→ Auto-import + auto-sort bank transactions (no more manual dragging!)

→ Scan unlimited receipts; even blurry, crumpled, or half-in-Hindi ones

→ Set automated payment reminders (so you don’t have to chase)

→ First 10 payments each month? Processing fees drop to zero (yes, $0!)

→ Priority support because sometimes you just need a human

Start free. Upgrade when you’re ready. No pressure. No guilt.

There was a time, not long ago, when my “filing system” was a shoebox labeled “TAX STUFF???” in Sharpie.

Then I found Wave.

One rainy afternoon, I opened the app and snapped 17 receipts. They were coffee-stained, faded, some in Hindi, some in English. Then I clicked Wave app and watched, jaw slightly open, as Wave pulled out the date, the amount, the merchant, even the GST.

Twelve minutes. That’s all it took.

Then I tagged them all—“Travel,” “Office Supplies,” “Client Lunch.”

Synced. Sorted. Done.

I sat back. Sipped my chai. And whispered, “Where have you been all my life?”

That’s 20 minutes saved every month. Multiply that over a year? That’s a full vacation day. Spent however you want. Not squinting at spreadsheets.

How to Scan Receipts (My “While Waiting for Chai” Trick)

Seriously, this takes less time than your kettle takes to boil.

- Download the Wave Receipts App (iOS or Android).

- Snap a pic.

- Wave pulls out: Who you paid, when, how much, and what tax was charged.

- Tap to confirm the category: “Stationery,” “Travel,” “Meals with Client.”

- It syncs instantly to your dashboard. Done. Go pour that second cup.

Pro move? Use Bulk Edit; select 10 receipts, tag them all as “Conference Expenses.” Saves ages.

💡 One Thing Most People Don’t Realize (Until It’s Too Late)

70% of small businesses switch tools in their first year.

Why?

They picked based on “cool features”; not their actual, daily, and hair-pulling pain point.

Don’t be that person.

Try one tool. Test one function; like receipt scanning or invoice reminders.

Use it for two weeks.

Then decide.

Wave isn’t the flashiest. It doesn’t have 50 tabs or fancy dashboards.

But if you’re a solopreneur who just wants to stay organized, sleep at night, and not pay a dime until you’re ready?

It’s your quiet hero.

🫶 Why Wave is a Gamechanger AI Bookkeeping Tool

Why Wave Feels Like a Gift (Especially in 2025)

It speaks your language, literally.

Hindi? Tamil? Bengali? Spanish? French?

Wave scans, sorts, and understands them all. Perfect if you’re working with global clients or traveling for gigs.

Multi-currency? Auto-converted.

Tax categories? Pre-loaded for India, US, Canada, UK.

Receipts in rupees, dollars, euros? No problem.

And it doesn’t sell your data.

It doesn’t shove ads in your face.

It doesn’t upsell you every time you log in.

It just… works.

Quietly. Faithfully. Like a good friend who shows up with tea and says,

“I’ve got this. You go rest.”

Which Tool Fits Your Pain Point?

→ Hate chasing payments? → FreshBooks

→ Drowning in receipts? → Wave (your new best friend)

→ Scaling fast? → Zoho Books or QuickBooks

→ Always anxious about cash? → Xero

Pro Tip:

Don’t try to use them all. Pick one. Master it. Let it carry the load.

Start with Wave’s free plan or Zoho’s free tier. Test deeply. See what feels right.

Yes, you can literally talk to it now. Say:

“Log ₹350 for printer ink.”

And it does. No typing. No stress. Just… done.

Now, if you’re ready to go deeper, head over to our full guide on the Best AI Apps for Finance & Accounting in 2025.

These tools didn’t just save me time. They gave me back peace of mind. No more Sunday night finance dread. No more “Did I log that Uber?” panic. No more guessing if I can afford that new laptop.

My 2025 Ritual:

→ Monday: Scan receipts with Wave while chai brews.

→ Wednesday: Check Xero’s cash flow forecast over lunch.

→ Friday: Zoho works on the accounts, so I can start planning my next trip.

Total time spent: < 20 mins/week.

Time reclaimed: 4+ hours.

Mental space gained: Priceless.

👉 Start today.

→ Freelancer? Try Wave (free).

→ Scaling biz? Zoho Books or QuickBooks.

→ Planner? Xero.

→ Invoice chaser? FreshBooks.

Your turn: What’s your #1 finance headache right now? Drop it in the comments. I’ll reply with a tool + tip just for you. Let’s turn your money chaos into calm, together.

References & Credits

Credit is given to the respective sources and websites linked throughout this post for the data, examples, and insights used here.

❓ FAQ: The Questions I Answered in This Post

Do I need to be an accountant?

Which is best for Indian freelancers?

Is my data safe?

Can AI replace my CA?

What if I’m not tech-savvy?

What are the best AI accounting and bookkeeping tools?

What are the most affordable AI accounting apps for freelancers?

What is the price of AI accounting software?

Is there any free AI accounting software I can use for my business?

How do leading AI bookkeeping tools compare?

How do Zoho Books and QuickBooks AI features compare?

Is AI bookkeeping a better solution than a human bookkeeper?

How can I use AI to automate my bookkeeping workflow?

How does AI help with financial reporting?

Can AI help me with my business's tax preparation?

What is the future of accounting with AI?

⚖️ Disclaimer: AI Bookkeeping Tools Are Helpful, But Not Foolproof

This post is here to educate and inform. It’s not to give financial, legal, or tax advice.

Every business is different. What works beautifully for one founder might not fit your model, team, or goals.

The tools I mention (e.g., QuickBooks, Xero, or Fathom) are shared to show how AI can simplify bookkeeping, forecasting, and compliance. But your results? They’ll depend on how you use them, your workflow, and your needs.

I’ve double-checked pricing, features, and facts using official sources as of mid-2025, but AI moves fast. Plans change. Features evolve. Prices shift. So, always visit the tool’s official website before signing up or making a decision.

And one more thing: AI doesn’t replace professional judgment. When things get complex, talk to a certified accountant, auditor, or financial advisor who knows your business.

Author's Note

Welcome to aiappdomain.com. I’m Barnali! Yes, that Barnali who’s spent 25+ years polishing academic journals, STM books, and research papers until they gleam.

I’ve chased commas, tamed passive voice, and turned tangled paragraphs into crystal-clear prose. But here’s the twist: these days, I’m just as obsessed with AI-powered balance sheets as I am with semicolons.

Here on this website, I’m sharing my experience to guide you, and you can count on me to bring the insight and trust to make aiappdomain.com your go-to spot!

Please see the Author page.

If you enjoyed this post, do not forget to share it with your friends or colleagues who might find it useful too. Let us spread the knowledge and make smarter, faster solutions accessible to everyone!

With chai-stained keyboards and AI-powered hope,

— Barnali

P.S. Bookmark this. Share it with your freelancer bestie. When you save your first five hours, come back and tell me. I’ll celebrate with you (virtually, with confetti emojis