Have you ever opened your laptop on a Sunday night, promising yourself you’d just knock out a bit of bookkeeping, only to lose two hours chasing missing receipts, mismatched invoices, and overdue payment reminders? It’s a familiar trap for freelancers who end up buried in financial admin instead of enjoying their weekend.

You’re not alone.

As a freelancer or solopreneur, you’re expected to be everything at once: creator, marketer, client wrangler, and accidental accountant.

But here’s the shift: you don’t have to do it all manually anymore.

In 2025, AI finance and accounting apps are doing the heavy lifting, such as automating expense tracking, smart budgeting, tax-ready reporting, and even cash flow forecasting. So, you can focus on the work that actually pays the bills.

In this guide, I’ll walk you through the best AI finance and accounting apps that real freelancers use to save 10+ hours a week, reduce financial stress, and make smarter money moves; no accounting degree required.

Table of Contents

ToggleKey Questions Answered in This Post

This post answers the most common questions freelancers and small business owners ask when it comes to AI finance and accounting apps in 2025:

- How do AI accounting apps help freelancers manage money better?

- Can AI bookkeeping tools really replace manual spreadsheets?

- What are the best AI apps for automating invoices and payments?

- How can AI tools predict cash flow and help avoid financial surprises?

- What’s the easiest way to automate taxes with AI?

- Which AI expense management apps work best for freelancers and solopreneurs?

- Can AI handle multi-currency transactions for international clients?

- What’s the difference between AI accounting software and traditional tools?

- Which AI apps for budgeting actually help you save more money?

- Are there free AI finance apps that are worth using in 2025?

- How do AI-powered forecasting tools support smarter business planning?

- Which AI tools can reduce bookkeeping errors and fraud risks?

- Can AI detect payment delays or help with client risk analysis?

- How can AI simplify financial reporting and tax compliance?

- What’s the best AI stack for freelancers — bookkeeping, forecasting, and invoicing all in one?

And if you’ve ever wondered “Where should I start?”, we’ll also explore:

👉 How to pick your first AI finance app, test it in a week, and scale your freelance accounting automation over time.

Before we jump into the tools, let’s be real: why is money so stressful for freelancers?

Your income isn’t steady. It’s a rollercoaster. One month you’re booked solid; the next, you’re wondering if that invoice will ever clear.

When payments drag, invoices disappear into client inboxes, or receipts pile up like unread emails, financial anxiety spikes—fast.

That’s exactly where AI finance and accounting apps come in.

They don’t replace your judgment or discipline.

Instead, they automate the tedious, time-sucking tasks. So, you can stay on top of your money without living in spreadsheets.

AI has transformed financial management from a chore into something smart, fast, and surprisingly intuitive.

The best AI finance and accounting apps work quietly in the background, such as scanning receipts the moment you snap them, auto-categorizing every transaction, nudging late-paying clients, and even flagging odd spending before it becomes a problem.

Here’s what AI actually delivers for your freelance finances:

• Speed: Sort expenses or generate invoices in seconds, not hours.

• Accuracy: Say goodbye to manual entry errors that throw off your books (and your tax prep).

• Insight: Machine learning spots trends in your cash flow. So, you can predict lean months before they hit.

And the best part? These tools plug right into your existing workflow, whether it’s PayPal, Google Sheets, Stripe, or your go-to invoicing platform. No complex systems. No steep learning curve. Just seamless, stress-free finance.

Now, let’s look at the most effective AI finance and accounting apps that real freelancers use to simplify money without sacrificing control.

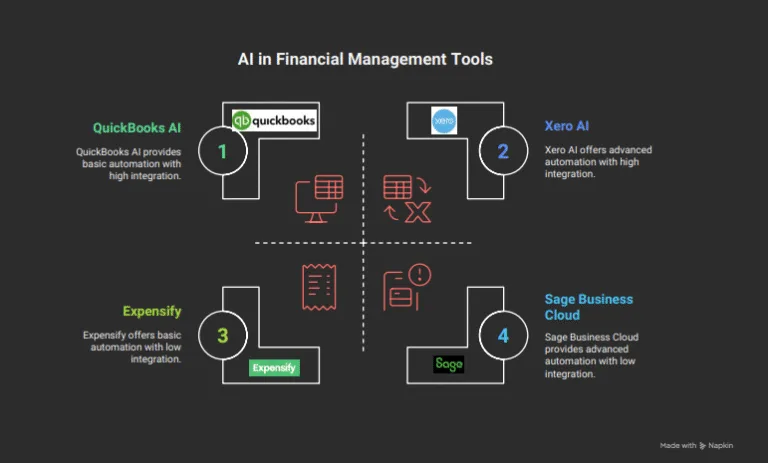

QuickBooks AI—Your All-in-One Accounting Partner

- Best for: Freelancers who want everything in one place

- Pricing: From US$18/month

- Features: Auto-categorizes expenses, generates smart reports, syncs with bank accounts

- Why I love it: QuickBooks doesn’t just record; it learns. After a few weeks, it automatically predicts how to classify expenses and saves you hours each month.

💡 A freelance content writer I know reduced her bookkeeping time from 12 hours a month to under 3 hours after switching to QuickBooks AI.

FreshBooks—Designed for Freelancers

- Best for: Solopreneurs who want simplicity

- Pricing: From $10.50/month

- Features: Time tracking, invoicing, AI-assisted tax summaries

- What stands out: FreshBooks’ AI predicts recurring clients and reminds you to invoice them; no more “Oops, I forgot!” moments.

Wave Accounting—The Best Free Option

- Best for: New freelancers on a tight budget

- Pricing: Free (with optional paid features). US$190 per year for pro.

- Features: AI-based expense tracking, invoicing, and financial dashboard

- Why it works: Wave offers 90% of what paid tools do, and it’s ideal for freelancers just testing the waters of automation.

- Best for: Freelancers who travel or juggle multiple clients

- Pricing: From $5/month

- Features: Scans receipts using OCR, categorizes expenses automatically, and syncs with QuickBooks or Xero.

- Real story: “When I used to travel for projects, I’d come back with a pile of receipts. Now I just snap photos, and Expensify files them perfectly.”

- Best for: Freelancers who dread tax season

- Pricing: Free basic plan, premium from $16/month

- Features: Uses AI to identify deductible expenses, file returns, and estimate taxes due

- What makes it special: It learns your spending habits and flags potential deductions you might miss.

- Best for: Freelancers dealing with multiple vendors or clients

- Pricing: Free, pro starts from $25/month

- Features: Automated payment scheduling, reminders, and multi-currency support

- Why it matters: Late payments can break a freelancer’s rhythm. Melio tracks due dates and nudges clients politely. So, you don’t have to.

- Best for: Freelancers managing irregular income

- Pricing: From US$9.99/month, billed annually

- Features: Cash flow forecasting, visual budgeting, “what-if” scenario modeling

- Use case: “I could finally see when my cash flow would dip and adjust my spending a month in advance.”

For a complete overview of how AI is transforming finance and accounting, don’t miss our Pillar Guide on AI Apps for Finance & Accounting.

When I first started freelancing, my “accounting system” was a chaotic mix of sticky notes, buried email threads, and one giant Excel sheet that gave me anxiety just opening it.

Spoiler: it was messy, error-prone, and exhausting.

Everything changed when I started using AI finance and accounting apps like QuickBooks AI and FlyFin.

Suddenly, invoices generated themselves. Tax-deductible expenses got flagged in real time. And for the first time, I didn’t dread March—aka tax panic season.

This isn’t just my story. Freelancers everywhere are getting similar wins:

Case study: Priya’s Design Studio (Bengaluru)

As a solo graphic designer, Priya used FreshBooks to automate her invoicing and payment reminders.

Result: She reclaimed 10 hours a month and saw 30% fewer late payments just by letting AI handle the follow-ups.

Case study: Ramesh’s Marketing Consultancy

Juggling income from five clients with wildly inconsistent payments, Ramesh turned to PocketSmith.

The app’s cash flow forecasting showed a dip coming in March. So, he proactively cut non-essential spending.

Result: He avoided a cash crunch before it even hit.

These aren’t magic fixes. They’re smart uses of AI finance and accounting apps that turn financial chaos into calm, confident control.

Challenge | AI Fix | Recommended Tool |

Forgetting to invoice | Auto-invoicing reminders | FreshBooks, Zoho Invoice |

Missing deductions | AI-based expense scanning | FlyFin, Expensify |

Juggling irregular income | Cash flow forecasts | PocketSmith |

Losing receipts | OCR recognition | Expensify |

Overlapping client payments | Automated tracking | Melio |

Tax-time stress | AI-guided filing | H&R Block AI, QuickBooks SE |

“AI doesn’t replace your control; it gives you clarity.”

You don’t need all the tools at once. Start small and scale gradually.

Step 1: Identify your biggest pain point.

If invoices drive you crazy, start with FreshBooks or Zoho Invoice.

Step 2: Add a bookkeeping backbone.

Use QuickBooks or Wave to centralize all financial data.

Step 3: Automate forecasting and taxes.

Integrate PocketSmith or FlyFin for predictive insights.

Step 4: Connect everything with automation tools.

Use Zapier or Make.com to sync data between platforms.

We’re entering an era of AI-driven financial independence. Here’s what’s coming next:

- Voice-activated accounting assistants (imagine asking, “How much did I earn this week?”)

- Predictive invoicing that knows when clients typically delay payments

- Personalized financial coaching powered by AI

Task | Best AI App | Price | What It Automates |

Expense tracking | Expensify | From $5/mo | Scans and categorizes expenses |

Bookkeeping | QuickBooks AI | From $18/mo | Auto-classifies and reconciles accounts |

Invoicing | FreshBooks | From $10.50/mo | Creates and sends smart invoices |

Cash flow forecasting | PocketSmith | From $9.99/mo | Predicts future income and expenses |

Tax filing | FlyFin | From $16/mo | Flags deductions and files taxes |

Payments | Melio | Free, pro starts from $25/month | Automates client payment reminders |

Pick two apps:

- One for daily tracking (QuickBooks or Wave)

- One for income/tax management (FlyFin or PocketSmith)

Spend one weekend setting them up, and you’ll save dozens of hours throughout the year.

“The secret isn’t more tools. It’s using the right ones well.”

Freelancing gives you freedom, but financial chaos can quietly steal it back.

That’s why AI finance and accounting apps aren’t really about spreadsheets or ledgers.

They’re about peace of mind.

So, start small:

Automate the boring bits: receipt tracking, invoice chasing, expense categorizing.

Let AI manage the data. So, you can get back to building the business you dreamed of.

References & Credits

Credit is given to the respective sources and websites linked throughout this post for the data, examples, and insights used here.

FAQs: Managing Freelance Finances with AI Apps

What are the best AI finance and accounting apps for freelancers?

Can AI help freelancers manage irregular income?

How do AI apps simplify tax filing?

Are AI finance tools secure?

Can I use free AI accounting apps as a freelancer?

How much time can AI save on bookkeeping?

Do AI apps support multiple currencies for international clients?

Do I need accounting experience to use these tools?

How does AI help with budgeting?

What’s the first step to automate my freelance finances?

Can AI predict which clients might pay late?

What’s the biggest benefit of using AI for freelance finance?

What’s next for AI in freelance finance?

Can AI help me grow my business—not just manage money?

What’s the best AI app combo for freelancers?

💡 Bonus Tip

“The more consistently you use your AI apps, the smarter they get.”

Over time, they learn your billing cycles, spending habits, and client patterns. So, your forecasts, invoices, and insights become eerily accurate.

Just give them a little data… and they’ll give you back your time.

Learn More about AIAppDomain

Check out the below posts to learn more about how AI tools are helping small business owners:

Just give them a little data… and they’ll give you back your time.

Recent Posts

- Best AI Apps for Small Businesses: The Ultimate 2026 Tech Stack Shift to One Smart System

- AI Productivity Tools: Top Chrome & Mobile Apps to Boost Your Work in 2026

- AI for Marketing and Sales in 2026: Boost Engagement & Conversions

- AI by Industry 2026: Overview of Transformation (Healthcare, Education, Smart Life)

- Best AI Apps for Finance and Accounting in 2026 (Bookkeeping to Audits)

Glossary

Accounts Payable (AP): The money a business owes to its suppliers and vendors for goods or services received.

Accounts Receivable (AR): Money owed to a business by its clients or customers for goods or services already provided.

AI (Artificial Intelligence): The simulation of human intelligence processes by machines, especially computer systems, used in finance to automate tasks, analyze data, and make predictions.

Anomaly Detection: The process of identifying unusual patterns or data points that deviate significantly from the norm, often used by AI to spot fraudulent transactions.

Audit Preparation: The process of organizing financial records and data to ensure readiness for a formal examination of financial accounts.

Automated Bookkeeping: The use of software and AI to automatically record financial transactions, categorize expenses, reconcile accounts, and update ledgers, reducing manual data entry.

Cash Flow: The movement of money into and out of a business, which impacts its liquidity.

Cash Flow Forecasting: The process of predicting a business’s future cash inflows and outflows over a specific period, often enhanced by AI analysis.

Compliance Reporting: The process of preparing and submitting financial or operational reports to regulatory bodies to demonstrate adherence to laws, regulations, and standards.

Data Security: The protection of digital data from unauthorized access, corruption, or theft, especially important for AI-driven financial tools.

Expense Management: The process of tracking, recording, and processing a business’s expenses, frequently automated by AI tools.

Financial Forecasting: Estimating future financial outcomes, like revenue and expenses, by analyzing historical data and trends, often significantly enhanced by AI.

Financial Fraud: Deceptive practices used to gain an unfair or illegal financial advantage, which AI helps detect by identifying suspicious patterns.

Hyper-Automation: The application of advanced technologies, including AI and machine learning, to automate as many business processes as possible.

Invoice Chasing: The manual process of contacting clients to remind them of overdue payments, often automated by AI tools.

Invoicing: The process of generating and sending requests for payment to clients for goods or services provided.

ISO 27001: An international standard for information security management systems (ISMS), certifying that an organization has established, implemented, maintained, and continually improved its information security.

Machine Learning (ML): A subset of AI that enables systems to automatically learn and improve from experience without being explicitly programmed, crucial for AI’s analytical capabilities in finance.

Manual Bookkeeping: The traditional method of recording financial transactions by hand in ledgers or manually entering them into software without significant automation.

Predictive Analytics: The use of historical data, statistical algorithms, and machine learning to anticipate likely future outcomes.

Real-Time Data Analysis: The processing and analysis of data as it is collected, providing immediate insights and enabling quick decision-making.

Reconciliation: The process of comparing two sets of records (e.g., bank statements and internal ledgers) to ensure they agree and to identify any discrepancies.

Semantic Keyword: A specific phrase or concept that describes the core meaning or topic of a piece of content, often used to optimize content for search engines.

Spreadsheets: Computer applications used for organizing, analyzing, and storing data in tabular form, often requiring manual entry and prone to errors in complex financial tasks.

Tax Compliance: Adherence to tax laws and regulations, including accurate calculation and timely payment of taxes, often streamlined by AI tools.

Disclaimer

This blog post is meant to inform and educate in a general sense. It does not replace tailored advice from legal, financial, or technical experts.

A Few Important Notes:

- Examples given (like AI chatbots or predictive analytics) show possible uses of AI, not guaranteed results. Every business is different.

- Stats and trends come from credible sources, but AI evolves fast. What is true today might shift tomorrow. Always double-check the latest updates.

- Ethics and compliance are touched on briefly (e.g., privacy concerns and workforce impact), but this is not legal advice. When adopting AI, consult experts to stay compliant.

- Tools mentioned (e.g., cloud platforms, chatbot software) are for context, not recommendations. Research thoroughly to find what works for your needs.

- Success with AI depends on execution: the quality of your data, how well you implement solutions, and how prepared your team is.

By reading this, you agree:

- Any use of AI strategies or tools is your responsibility.

- The author and publisher are not liable for decisions made based on this content.

- Links to external sites are for convenience only. We do not vouch for their content.

- This disclaimer may be updated without notice. Questions? Reach out at www.aiappdomain.com.

Think of this post as a starting point, not a roadmap. Always adapt ideas to your unique situation!

Author's Note

I’m Barnali. I’m the author of this article.

Why am I diving into finance and accounting apps? I’ve begun using AI apps for my freelancing projects, and it’s helped me expand my small business by keeping my finances in check.

Working with these tools feels like organizing a messy ledger into a clear financial plan, bringing order to the chaos. Here on this website, I’m sharing my journey to guide you, and you can trust me to bring the wisdom and reliability to make aiappdomain.com your go-to resource!

Please see the Author page.

Reader's Note: Let's Talk Stress-Free Finances

Money management isn’t a hobby, but it’s the non-negotiable heartbeat of every small business. AI quietly steps in to take over the routine dread: tracking expenses, sending invoices, and spotting errors before they become five-figure headaches.

So, what AI accounting tool finally balanced your books without the late-night number crunching?

Share your time-saver in the comments! Your favorite app might be the solution another entrepreneur has been searching for.

The Takeaway: Automate the numbers, and you free up time to focus on the growth that truly counts.

very informative articles or reviews at this time.

Thanks for your comment! Read my latest blog post on comparison between top AI Apps for small businesses.

ai therapist chatbot [url=https://www.ai-therapist1.com]https://www.ai-therapist1.com[/url] .

I do not even understand how I ended up here, but I assumed this publish used to be great

Thanks for your comment! Read my latest blog post on comparison between top AI Apps for small businesses.